When selecting candidates, look for individuals with excellent communication skills, problem-solving abilities, and a customer-centric mindset. Conduct thorough interviews and assessments to ensure candidates possess the necessary skills and temperament to excel in a service-oriented role. A service department that goes above and beyond to meet customer needs creates opportunities for upselling and cross-selling. When customers have a positive experience with a product or service, they are more inclined to explore other offerings from the same brand, resulting in increased revenue. In today’s technology-driven world, many products and services require technical support.

Mobile Services

Customer feedback is an invaluable resource since customers directly interact with your customer service team. Positive feedback celebrates the efforts of your organization, while constructive criticism highlights areas that require attention and improvement. In the era of social media, customers often share their experiences, both positive and negative, on company pages.

Harnessing The Power Of Customer Feedback

- Also, before outsourcing, consider that the loss of your service department personnel may make it impossible to reconstitute the department in the future, if the outsourcing relationship turns bad.

- Ever lost your keys and wasted a half hour running through your house checking under every couch cushion and in every cupboard?

- Essential skills for a manager include diplomacy and empathy, crucial for retaining loyal customers and supporting team members in various tasks.

- In the era of social media, customers often share their experiences, both positive and negative, on company pages.

Activate your 30-day free trial, and fix your shuttle processes forever. You can offer your customers an extended warranty as part of their purchase or lease agreement. This means that they will pay for the coverage before they take possession of their vehicle. By providing your phone number, you are consenting to receive calls and recurring SMS/MMS messages, including autodialed and automated calls and texts, to that number from the Judicial Watch. Judicial Watch has more than 25 FOIA and open records currently pending on the shooting of Trump with the Biden administration and local and state officials and agencies in Pennsylvania. Want to receive guidance on joining the Foreign Service, including recommended preparation resources?

Customer Service Department: Team Structure And Responsibilities

When you take care of your people, your people will take care of your business. Client relationship managers play a crucial role in building strong customer loyalty. Their primary responsibility is to develop and nurture relationships with new customers. Exceptional client relationship managers possess excellent problem-solving skills and the ability to address complex issues while maintaining a high level of professionalism. Their primary responsibilities revolve around ensuring customer satisfaction and building solid relationships through the effective management of inbound requests. This includes handling orders, processing returns and exchanges, as well as addressing and resolving customer complaints.

My Career Journey: Yurii Maidan, Chief Customer Officer

Consultants of the first tier are solving the simplest and most common clients’ issues. They are the first ones who the customers come in contact with and most of the time they are able to resolve whatever issue comes up. Let’s dive deeper into the intricacies of a service department and explore the various aspects that contribute to its success. An extended warranty is a service plan that covers parts and labor costs on a vehicle after the manufacturer’s warranty expires. It can last up to 3 years after the end of the original manufacturer’s warranty. The best way to get customers talking about your business is to make sure that you are meeting their needs in a way that they can see and feel the difference.

These costs would then be included when determining the total cost of production for each department. These changes present both challenges and opportunities for career diplomats and aspiring FSOs. The second Trump administration will likely prioritize swiftly free online bookkeeping course and training implementing its “America First” agenda through strategic staffing decisions. Learning from the hiring delays of the first term, the administration will probably pursue more efficient appointment processes and greater control over personnel decisions.

You see, when your service department is running smoothly and efficiently, it creates a ripple effect throughout your whole dealership. The happier and more satisfied your customers are with their car repair experiences, the more likely they are to come back for future services or purchases. It requires extensive knowledge of every aspect of the business, from customer service to mechanical repairs.

It is crucial to handle these situations promptly and professionally. Train your team to remain calm, actively listen to customer concerns, and provide fair resolutions. Adopt a problem-solving approach and focus on retaining customer satisfaction even in challenging situations. By turning unhappy customers into satisfied ones, you can rebuild trust and strengthen customer relationships. One of the primary objectives of a service department is to resolve customer issues. By employing skilled and knowledgeable staff, the department can tackle problems head-on, finding solutions that meet the customer’s needs and expectations.

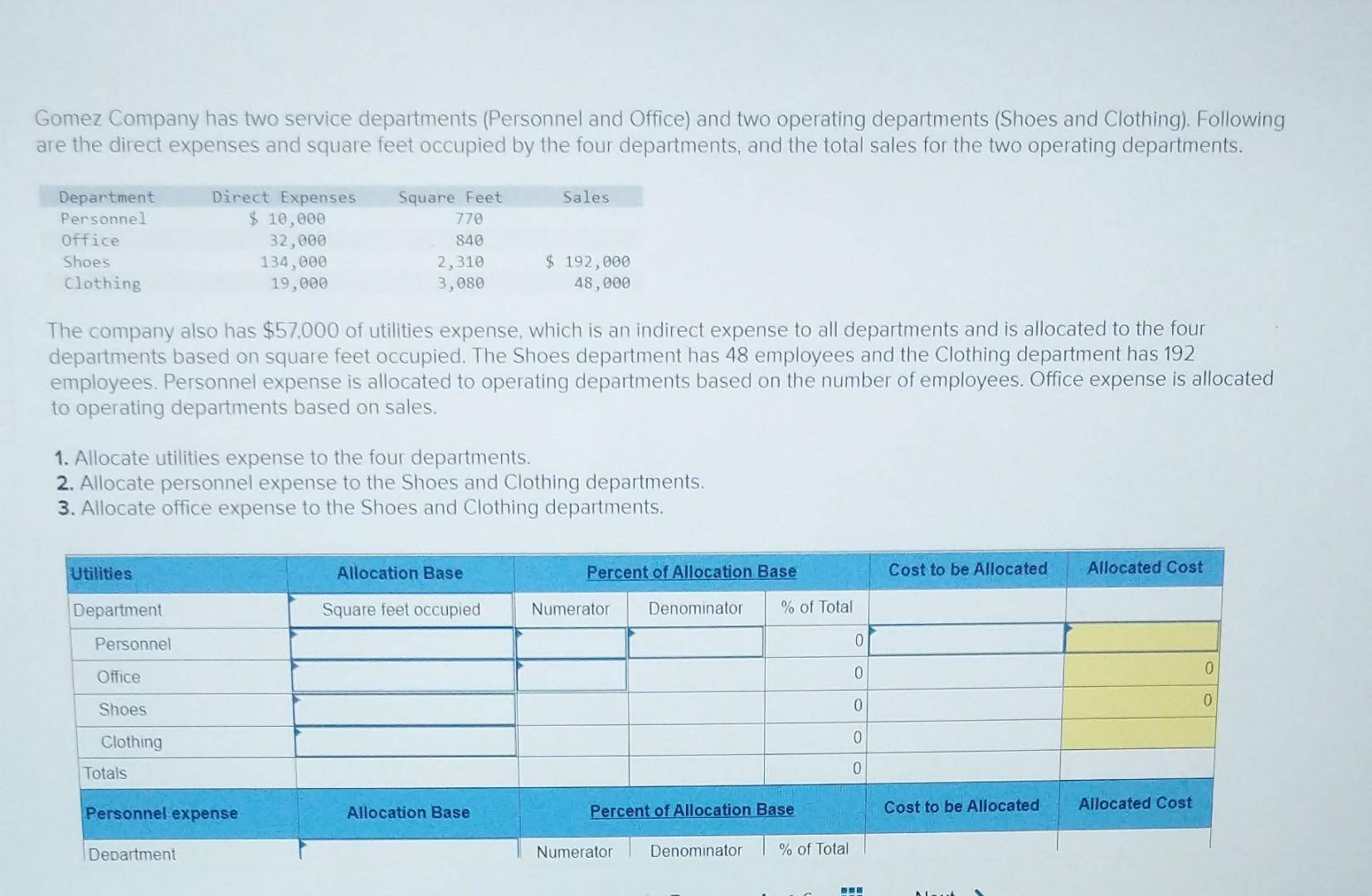

The costs incurred by the service departments are considered to be indirect manufacturing costs that ultimately must get allocated to the goods produced. When customers have positive experiences with a service department, they are more likely to share their experiences with friends, family, and colleagues. This positive word-of-mouth not only strengthens the brand’s reputation but also attracts new customers. Creating the best customer experience starts with listening to your customers and understanding their needs. When you know what they want, you can give it to them, which will keep them coming back time and time again.